Product Catalogue

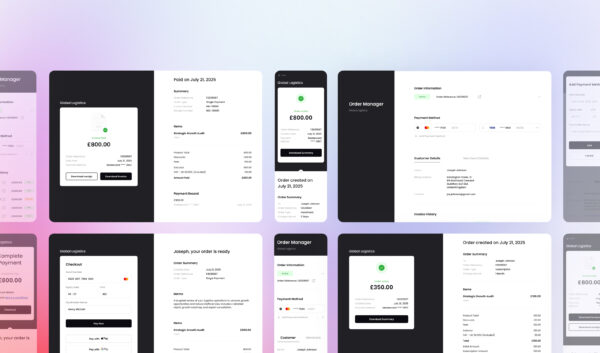

Create products and define purchase type, pricing, currency and payment configuration

Create products and define purchase type, pricing, currency and payment configuration

Import customers or add on the fly; payment cards and orders are automatically linked

Track and manage everything from one centralised dashboard and reporting suite

Full purchase price paid in a single payment event

Purchase price split across several instalments

Metered, variable amount charged at regular or irregular interval

Recurring, fixed amount charged at regular interval until cancelled

Whether you make one-off sales or allow instalments, need to calculate metered billing or offer subscriptions, BillPro has you covered

Learn moreBillPro brings together phone, email, sms,

face-to-face and web payments in a single solution.

James M. - Director, Trust Family Associates

Key in phone orders by virtual terminal

Send payment links by email, sms, or messenger

Present QR codes for face-to-face checkouts

Integrate our hosted iframe for web checkout

Log in with Stripe and activate BillPro instantly, or create a new Stripe account via Stripe Connect.

The quickest way to get started with BillPro.

Start for Free with Stripe

Stripe not right for you? BillPro partners with CardCorp to deliver your perfect merchant account.

Stripe vs. CardCorp - what’s the difference?

Compare Providers72%

Increase in conversions on average

0.04%

Customer disputes resulting in chargeback

12x Revs

More than 1,200% increase in recurring turnover

This BillPro merchant grew revenues 12X with flexible instalments

Learn how

Real time insights backed by the strategic data you need to take informed action.

Get a clear view of revenues, delineate between one-time sales and MRR growth, track customer retention.

Don’t like demo calls? Get Started for Free

Benefit from more than 20 event-triggered messages and notifications that relay order and payment related information to your clients automatically.

Learn more

Minimise revenue loss and prevent involuntary churn with smart auto-retry. Parse decline reasons and reprocess eligible payments at preset intervals.

Spend less time chasing payments Spend less time chasing paymentsReduce your team’s workload by up to 80% by automating the dunning and recovery escalation cascade.

Send contextually relevant automated messages to advise customers when payments fail and prompt them to take action.

80%

Reduction in your team’s workload

How much will your business save by automating its recurring billing processes?

Your products define your business. Create and instantly populate product profiles to your product catalogue.

Learn MoreKeep revenue streams on track and nurture customer relationships with smart auto-retry and personalised automatic dunning messages.

Learn MoreGain deep insights and tailor your interactions with customers based on their transactions, preferences, and support history.

Learn More

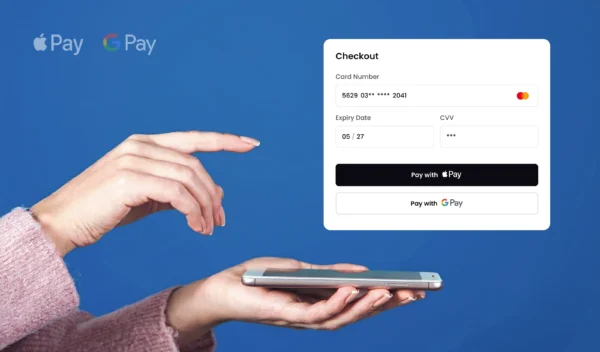

Getting paid on time is only part of the picture. It’s just as important to give your customers a smooth,...

BillPro now supports Apple Pay and Google Pay, making checkout faster, simpler, and more secure for your customers. By offering...

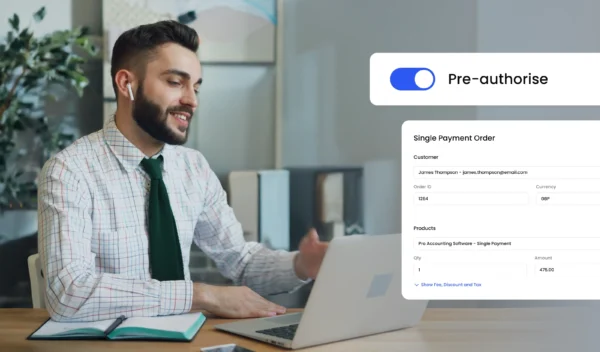

Prepayment is no longer just a nice-to-have when running a business – it’s a necessity and a safeguard for business...