Billing is essential for every business, yet it can become complex and time-consuming. This is especially true as recurring billing and digital payments grow across the UK and EU. Customers now prefer subscriptions and automated payments, so companies must adapt quickly to stay competitive.

Recent UK Finance reports show strong growth in digital transactions. The European Commission also notes rapid digital transformation across all EU member states. To keep up with this shift, businesses need tools that:

- streamline processes,

- reduce errors, and

- meet changing customer expectations.

Billing orchestration delivers exactly that.

In this guide, you’ll learn what billing orchestration is, the benefits it offers, and how a reliable billing platform like BillPro can support sustainable growth.

What is Billing Orchestration?

Billing orchestration is the automated coordination of all billing tasks within a business. It brings everything together – from invoice generation and payment processing to subscription management and failed payment retries.

By automating these processes, businesses save time, reduce manual work, and minimise errors. The result is faster, more accurate, and more efficient billing.

BillPro is a great example of a billing platform that enables this. It centralises your billing operations and connects multiple payment channels and currencies. This unified approach improves flexibility, simplifies management, and gives businesses greater financial control.

Why Your Business Needs Billing Orchestration

As competition rises and customer expectations evolve, effective billing management has never been more important. Businesses need streamlined systems that can grow alongside them — especially as subscription and recurring payment models continue to expand.

Between 2023 and 2027, subscription commerce in Europe is expected to grow by 68%. In the UK, subscription services have increased by more than 23% each year since 2020. Meanwhile, digital payments across the EU are forecast to reach €802 billion by 2026.

To stay competitive in this fast-changing landscape, businesses must offer seamless, accurate, and customer-friendly billing experiences. That’s where billing orchestration makes a difference.

Below are four key reasons to consider it for your business:

1. Simplified Billing Processes

With payment automation, your team spends less time manually creating invoices or tracking payments. Automated recurring billing takes over repetitive tasks, reducing errors and saving hours of manual work.

This allows your staff to focus on strategic activities — not routine administration — driving real business growth.

2. Enhanced Customer Satisfaction

Customers expect digital payments to be quick, secure, and effortless. A billing platform like BillPro simplifies subscription handling, invoicing, and payment collection, all in one place.

This results in smoother transactions, fewer payment failures, and greater customer satisfaction — which directly improves retention rates.

3. Reduced Errors and Costs

Manual billing processes are prone to mistakes that can lead to revenue loss and customer frustration. Automating your invoicing and payment workflows significantly reduces these errors while cutting administrative costs.

A well-implemented orchestration setup also helps:

- Prevent failed payments,

- Improve cash flow, and

- Ensure your billing data is always accurate and up to date.

4. Efficient Subscription Management

For businesses built on recurring revenue, strong subscription management software is essential.

With BillPro, you can manage everything from one dashboard — renewals, upgrades, downgrades, and cancellations. This unified control simplifies your operations and gives you a clearer overview of customer activity.

Essential Features of a Billing Platform

The key to successful billing orchestration lies in choosing the right billing platform. The ideal platform should offer features that directly match your business needs — helping you automate processes, save time, and scale efficiently.

Below are the essential features to look for:

Feature | Benefits |

Invoice Generator | Creates instant, accurate invoices with minimal manual input. |

Subscription Management Software | Simplifies the full subscription lifecycle – from sign-up to renewal or cancellation. |

Multi-Currency Support | Enables smooth international transactions and global reach. |

Payment Gateway Integration | Offers flexible digital payment options across multiple channels. |

Smart Retry & Dunning Automation | Reduces churn and improves payment recovery after failed transactions. |

Flexible Billing Models | Allows customised billing structures for different customer types and services. |

Reporting and Analytics | Provides actionable insights to support smarter business decisions. |

Including these features in your chosen billing platform can dramatically improve accuracy, efficiency, and customer satisfaction.

If you’re not sure where to start, take a look at our guide on how to choose the best billing platform.

To explore specific solutions, check out BillPro’s tools such as retry and dunning automation, diverse billing models, and its intuitive dashboard — all designed to simplify billing and accelerate growth.

Implementing Billing Orchestration in Your Business

Adopting billing orchestration can transform how your company handles payments and subscriptions. Follow these practical steps to implement it effectively:

Step 1: Evaluate Your Billing Needs

Start by identifying your main challenges. Are you dealing with manual invoicing, frequent billing errors, or inefficient subscription management?

Understanding these problems will help you choose a platform that truly fits your requirements.

Step 2: Select the Right Billing Platform

Research different solutions and look for a platform that includes:

- Automated invoicing and payment processing,

- Robust subscription management tools,

- Flexible billing options, and

- Comprehensive payment support.

With digital payments and subscriptions growing rapidly across the UK and EU, platforms like BillPro are built to handle these demands. Review BillPro’s transparent pricing to confirm it aligns with your goals and budget.

Step 3: Integrate and Automate

Once selected, connect your billing platform to your CRM, accounting, and other business systems.

BillPro’s API documentation makes integration straightforward. Automating invoicing and subscription management greatly improves accuracy and reduces administrative work.

Step 4: Train Your Team

Ensure your team knows how to use the new system effectively. Proper onboarding helps them adopt the platform smoothly and make full use of its features.

With BillPro, you can assign specific user roles so that accountants, sales staff, and managers have the right level of access for their tasks.

Step 5: Monitor and Optimise

Once your billing orchestration is live, track its performance regularly.

Use BillPro’s dashboard, Payments screens, and Reports to:

- Monitor transactions,

- Identify failed payments, and

- Optimise recurring billing performance.

Ongoing monitoring helps you resolve issues early, refine workflows, and continually improve your billing efficiency.

Conclusion

In today’s fast-changing world of subscriptions and digital payments, billing orchestration has become essential. The right billing platform doesn’t just simplify invoicing — it also improves customer experiences and gives you insights that drive smarter decisions.

BillPro brings all these benefits together. It helps businesses cut costs, increase efficiency, and build sustainable growth through automation and clear financial visibility.

Start embracing billing orchestration today — and give your business the flexibility and confidence to thrive tomorrow.

FAQs

Does BillPro support the payment methods my customers prefer?

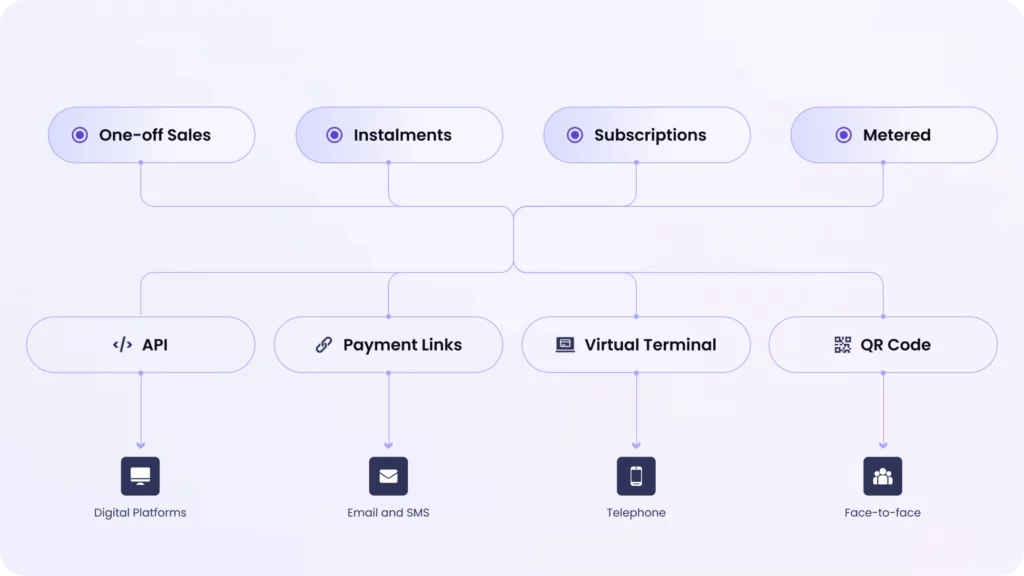

Yes, BillPro supports a range of popular payment methods, including credit cards, debit cards, phone payments, payment links, QR codes, and API-driven payments.

Can BillPro automate billing processes and reduce manual errors?

Absolutely. BillPro provides built-in payment automation features to simplify billing, reduce errors, and save valuable time.

Does BillPro integrate seamlessly with existing business software?

Yes, BillPro integrates easily with your existing CRM, accounting tools, and other essential business systems, helping streamline your operations.

Is BillPro scalable to support business growth?

Yes, BillPro is specifically designed to scale alongside your business, supporting growth and adapting to changing requirements easily.

Does BillPro offer robust reporting?

Yes, BillPro’s reporting tools provide valuable insights into payment trends, revenue forecasts, and subscription performance, empowering informed business decisions.

Does BillPro support international transactions and multiple currencies?

Definitely. BillPro supports multi-currency transactions, making it easy for businesses to handle international payments effortlessly.

How easy is it to integrate BillPro with existing business systems?

Integration is straightforward. BillPro’s detailed API documentation guides you through every step, ensuring a smooth and hassle-free integration experience.