Prepayment is no longer just a nice-to-have when running a business – it’s a necessity and a safeguard for business owners. Whether you take reservations, verify stock before shipping, or offer services that require approval before billing, the ability to secure funds without charging immediately can make all the difference.

With BillPro’s new capture and reverse pre-authorised payments feature, you now have complete control over when – and how much – you collect. In just a few clicks, you can capture or reverse a pre-authorisation payment, protecting your revenue and delivering a smoother experience for your customers.

What is a pre-authorisation payment?

A pre-authorisation is the process of temporarily holding a customer’s funds at the time of purchase without immediately taking the payment.

It’s a common practice across industries. For example, hotels often use pre-authorisation credit card transactions to secure funds before a guest checks in.

Instead of processing the payment right away, the money is held in reserve for a set period. You can then decide whether to capture pre-authorisation payment or release the hold, depending on how the order progresses.

💡Did you know?

Pre-authorisation isn’t just for hotels – it’s ideal for high-value goods, bookings, and custom orders. Businesses that use pre-authorisation can reduce refund processing time by up to 80%, because the funds were never actually taken until capture.

How does pre-authorisation work?

If you’re wondering how pre-authorisation works, here’s the simple process:

- Authorise the funds – The customer’s bank confirms they have enough balance and reserves the specified amount.

- Hold period begins – The money is set aside but hasn’t yet been transferred to your account.

- Decision point – You can either capture the funds to complete the payment or reverse the authorisation to release them.

💡Did you know?

Pre-authorisation can improve customer trust – 72% of shoppers say they’re more likely to purchase when they know they won’t be charged until the order is final.

This approach is especially useful when your business relies on order confirmation, quality checks, or inventory validation before taking payment. For more ways to improve stability in your payment flow, see how to reduce payment failures and improve cash flow.

Why this matters for your business

Being able to choose between capturing and reversing a pre-authorisation payment offers several key benefits:

- Capture when ready – Take the payment in full or partially once goods or services are confirmed.

- Reverse instantly if needed – Release the hold if an order is cancelled or amended.

- Reduce disputes and chargebacks – Only collect funds after everything is finalised.

- Build customer trust – Show transparency in how you handle payments. (BillPro’s Customer CRM makes this even easier by keeping client details and payment history in one place.)

- Simplify operations – Avoid complex refund processes later.

💡Did you know?

Pre-authorisation helps avoid double charges. Reversing pre-authorisation when the order is cancelled or not delivered incurs no additional fees. Compared to processing debit and refunds, where the merchant would pay transaction fees twice.

This flexibility works hand in hand with smarter tools for billing automation and scalability.

How to capture or reverse pre-authorisation in BillPro

Here’s how it works: In just a couple of minutes, this video shows you how to pre-authorise, capture, or reverse payments step by step.

BillPro makes managing pre-authorisation payments quick and straightforward.

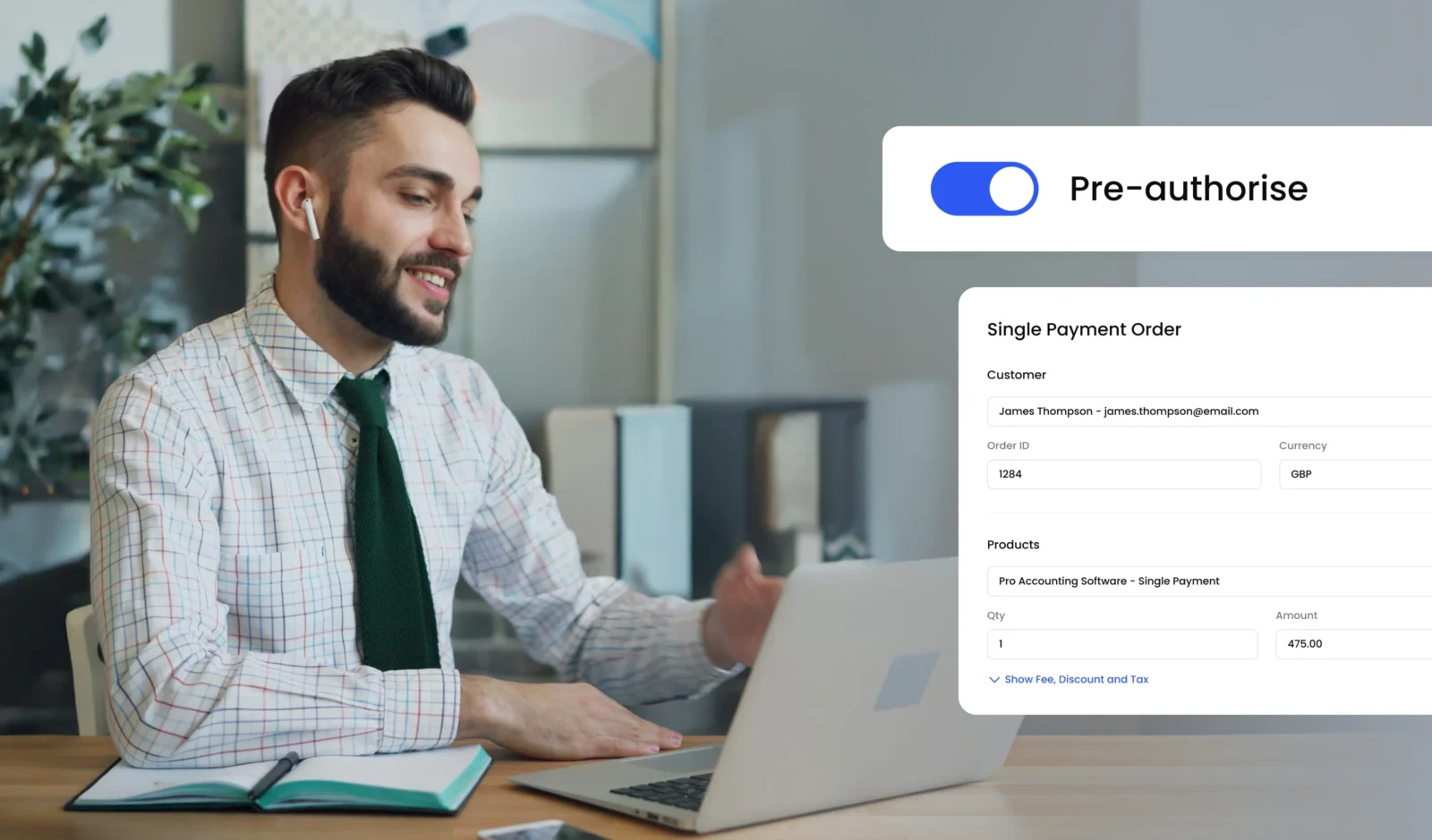

Step 1 – Pre-authorise the payment

When creating a single payment order, enable pre-authorisation. This reserves the funds without charging the customer.

Step 2 – Take action when ready

- Capture pre-authorisation payment – Click the capture icon, enter the full or partial amount, and confirm.

- Reverse pre-authorisation payment – Click the reverse icon to release the funds.

Step 3 – Track updates in real time

Your order status updates automatically, and the complete transaction history remains in your account for easy reference.

Who will benefit most?

This feature is perfect for:

- E-commerce retailers securing payment before dispatch.

- Hospitality businesses using pre-authorisation for bookings.

- Service providers confirming payment before starting work.

- Custom-order merchants ensuring funds are available before production.

- Rental platforms holding a security deposit and collecting the final rental fee on return.

- Healthcare and wellness providers securing reservations, authorising treatment packages, and capturing payment once the service is complete.

💡Did you know?

E-commerce merchants offering pre-authorisation as a payment option see up to 20% higher conversion rates for high-value items.

Get started today

The new capture and reverse pre-authorised payments feature is now live in all BillPro accounts – giving you the power to secure funds, protect your revenue, and offer customers a smoother payment experience.

Take control of your transactions, reduce payment risks, and give your customers confidence in every order. Not sure if your platform is ready for this? You can start by looking over our guide on how to choose the best billing platform.

Log in to your BillPro dashboard now and start using pre-authorisation to your advantage.

FAQs about pre-authorisation payments

1. What is a pre-authorisation payment?

A pre-authorisation payment is when funds are reserved on a customer’s card without being charged immediately. This ensures the money is available when you’re ready to process the payment.

2. How does pre-authorisation work?

The customer’s bank places the amount on hold for a set period. You can either capture the funds to complete the payment or reverse the hold to release them.

3. How long does a pre-authorisation last?

Typically, pre-authorisations last around 7 days, though the exact time depends on the card-issuing bank.

4. Can I capture only part of a pre-authorisation payment?

Yes, BillPro allows you to capture a partial amount, which is useful if the final total is lower than the reserved amount.

5. What happens if I reverse a pre-authorisation?

Reversing releases the reserved funds back to the customer. Since the money was never actually taken, this is faster than processing a refund.